OUR PROMOTIONS

- Commercial premises and offices in downtown and commercial areas

Example: brewery - pub "Au Bureau", clothing store "Okaïdi" in the city center; Fast food "Burger King" in commercial area

- Houses subdivisions in urban communes

Example: subdivision of houses in Burgundy and Betheny

- New apartments in the city center (many availabilities)

Example: The Residence The Elected: It offers 1 commercial space on the ground floor and 13 apartments, type 2 to type 5, with mostly balconies or terrace and possibility of parking in the basement secure.

Eligible for PINEL tax exemption, this new program can allow you to reduce your taxes in case of rental investment.

PINEL LAW: the 5 advantages for taxpayers

- 1- A significant tax reduction

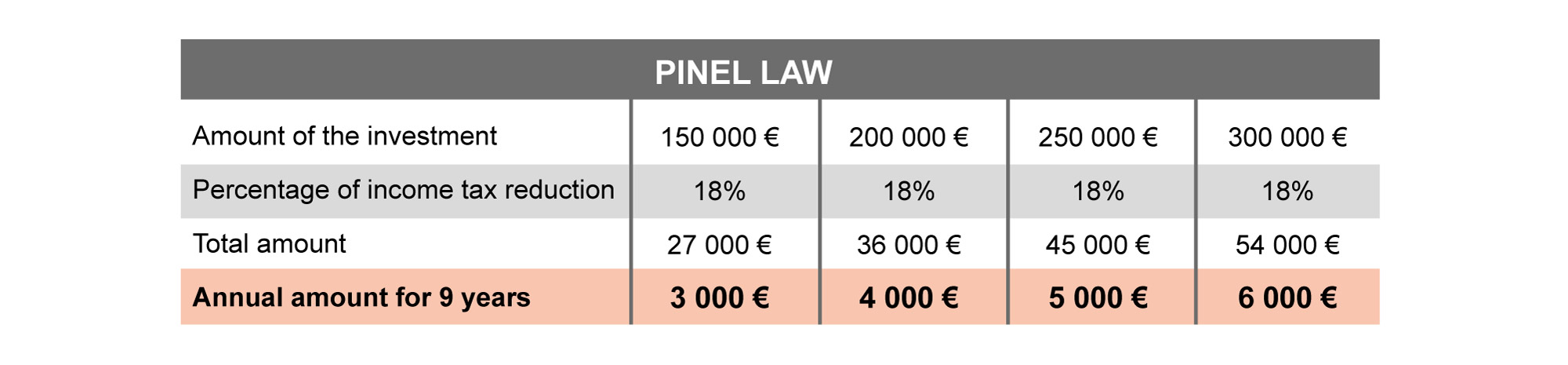

The amount of the tax benefit in Pinel law depends on the rental period:

21% of the price of the property for a rental period of 12 years

18% of the price of the property for a rental period of 9 years

12% of the price of the property for a rental period of 6 years

- 2- An investment without possible contribution

Buying real estate offers the advantage of being able to borrow to invest, which is not the case for investment in the financial markets. This possibility makes it possible to consider an investment without having to provide an initial contribution.

- 3- Constitution of a real estate heritage

Investment in stone is a financial investment with a long-term attractive rate of return. It helps to build a healthy heritage that will be easily transmitted.

- 4- Possibility to rent to his family

While this was not the case with the Duflot law, the Pinel law is applicable for family rents.

Parents can therefore buy a new home to house their child (ren) while enjoying the tax benefits of the Pinel device, provided that the tenant is not included in the tax home.

- 5- Prepare for retirement

At the end of the legal rental period of the housing, the owner has his property as he wishes. He can then continue to rent it to earn additional income, sell it to recover a capital gain or to occupy it as a second or main residence.